Articles

Which Payment Gateway Is Best for Your Business?

5.01.2021

eSellers understand the importance of providing a seamless user experience in their website or app, as well as the fact that a large part of customer satisfaction lies in eliminating barriers at checkout. In fact, according to a recent survey, with online payments fast becoming ubiquitous, customer experience is becoming the prime competitive differentiator.

The fastest and most effective way online businesses can deliver a smooth eCommerce customer experience through payments is by integrating a robust, secure payment gateway to their online platform. Not only does the merchant service reassure customers of your store’s trustworthiness, but it allows customers to transact online without the fear of being defrauded or robbed of their details.

The market is currently budding with a range of payment gateway providers that can be integrated with your website for a small fee, depending on the number of transactions your eCommerce store anticipates. However, they are not all created equal. That’s why it’s essential to do your homework when picking the best payment gateway for your business, to ensure that it’s user-friendly, affordable and secure.

Your bottom line depends on it!

An Introduction to Payment Gateways

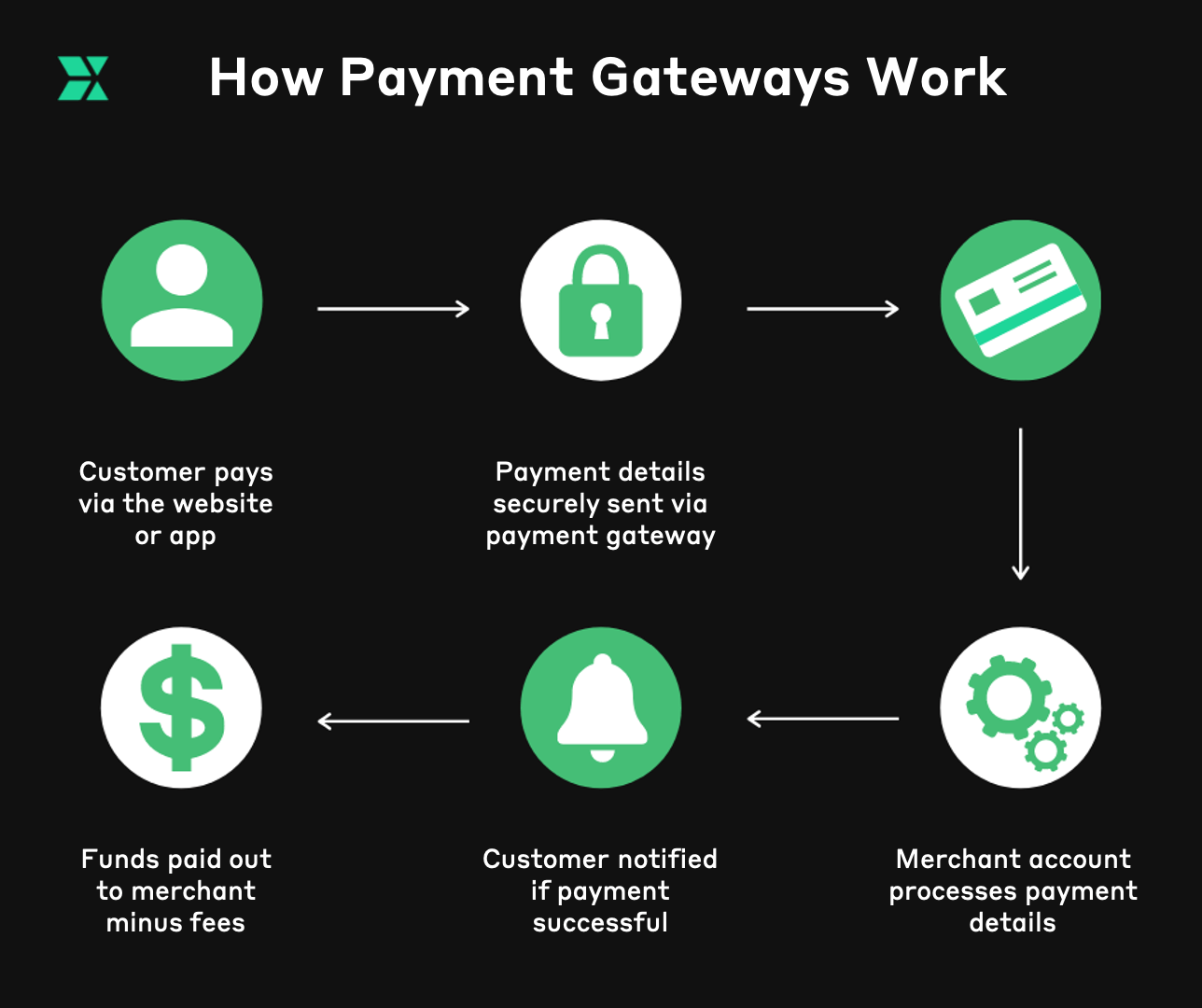

In essence, a payment gateway is a software application that interfaces between an eCommerce website and a customer’s preferred mode of payment. Essentially, it validates the customer’s credit or debit card details securely, ensures the necessary funds are available, and eventually ensures that the merchant gets paid.

While picking a payment gateway may be tedious, choosing the wrong one can be detrimental to your online store and may cause your business to suffer a significant drop in sales because of unsatisfied customers. That’s why the right payment gateway can prove to be key to ensuring long-term business success.

Here are the key components you should look for when choosing a payment gateway for your eCommerce store, to ensure a smooth, fast and secure customer payment experience:

- Security: The payment gateway you choose should follow information security standards to keep your customers’ data safe, and to ensure protection against fraudulent or hacking activities.

- Payout Time: The average payout time for payment gateways is usually weekly or bi-weekly. When picking a payment gateway, make sure you read their terms to determine if they offer a reasonable amount of time for payouts.

- Ease of Website Integration: Integrating the payment gateway should be simple and not require too many technical resources. It’s also important to check if the payment gateway offers sufficient customer support so that issues can be resolved without any hassle.

- Multi-Currency: If you have a global business, then make sure your payment gateway provider supports multi-currency payments. Importantly, also check if the payment gateway supports your online store’s country as some jurisdictions may not be covered.

- Fees: Payment fees charged to a merchant depend on various factors, including the risk of the transaction, type of card used by the customer, and the fixed pricing model preferred by specific payment processors. Make sure transaction and handling fees fall within your budget and be careful of hidden account maintenance fees when doing your research.

- Payment Location: Payment gateways either allow customers to complete a transaction within the checkout processes of the website or redirect them to another site to finalise. Some have an API that incorporates directly into your site, while others reroute visitors to third-party sites. When choosing which is best for your business, consider what will provide the best user experience for your shoppers.

The Top 10 Payment Gateways For Your Business

Here are Currenxie’s top payment gateways for your online business, supported by our Global Account:

-

PayPal

As one of the top-rated payment gateways — used by the likes of Adidas, Disney and Etsy — the main purpose of PayPal is to help facilitate payments and enable money transfers between businesses and people, without them having to provide financial information. Only an email address is required, and users can send or receive money across the globe instantly.

Key Features:

- Paypal operates in 203 countries and supports widely used debit and credit cards like Visa, Mastercard and American Express.

- Its payment gateway works with most merchant accounts, processors and shopping carts, as well as all leading eCommerce solutions, CRMs, sales management tools, and accounting systems.

- PayPal has no setup, gateway or monthly fees — it only charges a per-transaction service charge. Fixed fees for standard transactions are location-dependent.

- The payment gateway also has a strong anti-fraud team, however, customer service is known to be inconsistent.

-

Stripe

Considered one of the easiest payment gateways to set up, integrate and maintain, Stripe allows customers to stay onsite while making a payment — unlike PayPal that redirects one. Slack, Spotify, Lyft, UNICEF and HubSpot are some of Stripe’s most notable clients.

Key Features:

- Ideal for international merchants, Stripe is available in 39 countries and accepts payments from anywhere in the world.

- It allows businesses to achieve true customisation through its developer-first approach and adaptable API.

- Online payments usually take 7 days to process, and there are no hidden monthly refund or setup fees.

- Stripe accepts alternate payment types such as cryptocurrencies like Bitcoin.

-

Amazon Pay

Backed by the biggest name in eCommerce, Amazon Pay is specially designed for Amazon merchants and shoppers. Easy, fast and secure, the payment gateway is loaded with features and tools that attract customers and encourage them to buy more. With the help of a single login, the customer is instantly recognised, allowing them to complete their Amazon purchases in a familiar way.

Key Features:

- Only available to merchants established in 16 countries, Amazon Pay allows payments to be made in several languages and supports all leading currencies.

- Amazon Pay is driven by a simple API and provides multiple eCommerce platforms with free plugins, making customisation easy. Plus, transactions are completed on your site.

- Besides standard transaction fees, Amazon Pay doesn’t have any additional charges for its 100% secure A-to-Z guarantee. They do, however, have additional fees and policies around refunds and charitable transactions.

- Amazon Pay is a leader in responsiveness and is available across all devices.

-

Square

Primarily recommended for brick and mortar stores, and created by Twitter co-founder Jack Dorsey, Square lets customers make payments on-the-go from any device, meaning that sales can be conducted online as well as on-location. Offering an intuitive and user-friendly experience to merchants, Square is considered a primary solution for mobile payment processing.

Key Features:

- Square is currently available in five countries, including the US, Canada, Japan, Australia and the UK.

- Business owners can opt for a percentage fee per transaction, or a monthly flat rate of US$275 — with no additional fees. There are no long-term contracts and no lock-in.

- With Square, merchants often get paid out the next day.

- The mobile credit-card processing application captures the user’s payment information at the point-of-sale. It then works with Credit Card payment gateways to route the transactions directly.

-

2Checkout

While it may be costlier than some of its competitors, 2Checkout is considered a primary choice for merchants who want instant payouts and easy integration facilities that ensure their checkout experience stays seamlessly on brand. Ideal for international merchants, the US-based payment gateway supports multiple payment methods and transactions across the globe.

Key Features:

- 2Checkout offers services in 234 countries, 15 languages, and 87 different currencies and it accepts payments in the form of credit cards, PayPal, and debit cards.

- It has a fixed fee structure and doesn’t require any monthly or setup fees. However, international payment conversion rates are 2-5% higher than most banks.

- 2Checkout allows you to demo the customer’s buying experience to get a feel for how the payment gateway works before using it.

- The payment gateway also has an easy-to-incorporate API that allows credit card processing to be directly embedded onto your site.

-

SecurePay

Directed at SMEs and startups, SecurePay provides a vast range of payment options with easy registration and integration. Considered the leader in the Australian online payments industry, SecurePay provides a wide range of payment options and integration with many of the major online marketplaces.

Key Features:

- Open to Asia-Pacific countries, the company offers a free demo before opting for their service so you can test the payment gateway’s integration on your eStore.

- Fees are set a standard 1.75% + AU$0.30 for all Australian cards and 2.9% + AU$0.30 for all international cards. There are also no setup, annual or monthly fees and no additional fees for American Express, Diners Club or PayPal. There is a standard US$25 chargeback fee, as well as hidden service termination fees.

- SecurePay offers detailed reporting so that merchants can accurately track their sales. They also promise advanced fraud protection and batch processing of payments.

-

Checkout.com

Similar to Stripe and 2Checkout, Checkout.com bundles its payment gateway with a merchant account as part of its all-in-one software solution. The US$2 billion payment startup has been hailed for its commitment to pricing transparency by publishing its charges online. The breadth of its services makes them a competitive choice for a wide range of merchants.

Key Features:

- The company supports payments in 159 currencies and 18 different payment methods, including alternate payment methods like Apple Pay.

- Offering a customised payment structure, Checkout.com’s pricing is relatively straightforward. The company promises ‘refreshingly transparent pricing’, where fees are solely dependent on a client’s location, as well as transaction volume and sales history.

- They have no setup, account maintenance, service, or surprise fees. However, their customer support is known to be questionable.

- Integrated with all major shopping carts, Checkout.com accounts also include risk and fraud management tools.

-

Skrill

Skrill enables customers to purchase products and services across the world, and easily connect to any global bank account. Similar to PayPal, Skrill allows users to deposit funds into their accounts and spend them on online sites that accept Skrill payments. There are no charges when creating an account on Skrill, but there is a fixed percentage on processing fees.

Key Features:

- Easy to use and free to register, Skrill supports 38 currencies. The payment process is also fast, and funds uploaded into the merchant’s Skrill account immediately. Transferring money to your bank can take up to 5 working days.

- The more transactions you have, the lower your fees will be. However, be careful of fees to withdraw funds, as well as high currency conversion fees, plus handling fees.

- Skrill takes several security measures to ensure that its users are protected. All sensitive information is secured with 128-bit encryption. The mobile app has two-factor authentication.

-

BlueSnap

Enabling businesses to scale globally by helping them accept payments from local and international customers, BlueSnap — who counts Vodafone as one of their clients — has a built-in fraud prevention system to minimise customer risk. Easily integrated with top marketplaces and shopping cart platforms, BlueSnap has month-to-month contracts and no termination fees.

Key Features:

- With a network of over 30 acquiring banks that it has direct access to, BlueSnap operates in 180 countries. It supports 110 different types of payments, 100 currencies, and 29 different languages.

- Flat-rate pricing of 2.9% + US$0.30 is more costly for medium and large-sized businesses, and there is a US$75 monthly account maintenance fee for merchants who process less than US$2,500.

- BlueSnap is considered a fully-featured payment gateway that interfaces with procuring banks to guarantee the best conversion rate for every client.

- It’s notable for its Subscription Billing Engine where customers don’t need to enter their credit or debit card details.

-

Adyen

Providing modern end-to-end infrastructure and connecting directly to credit cards like Visa, Adyen is considered one of the world’s top payment platforms. Used by the likes of Uber, Spotify, Microsoft and eBay to handle transactions, Adyen allows eSellers to receive payments from a single platform while giving them the tools they need to manage risk and track results.

Key Features:

- Not only does Adyen accept more than 250 payment methods and 150 currencies, but it also allows merchants to obtain data-rich insights to learn more about their customers.

- Processing fees vary according to the method of payment used. For example, Adyen charges 3.95% for American Express and Interchange++ for Mastercard and Visa. Processing fees are set at US$0.12 for most transactions.

- There are no setup fees and users can link multiple bank accounts to the platform, as well as get direct access to all tools on signup. They also offer 24/7 in-house support.

Automatically receive payments from known gateways with a Currenxie Global Account. Sign up for yours today.